The Bee The Beetle And The Money Bug: Excerpt: Free Chapter

SAVINGS AND THE BUILDING

BLOCKS OF YOUR FINANCIAL LIFE

Saving up is a challenge. Just ask a worker bee.A dozen worker bees would have to work their entire livesto make a teaspoon of honey, which is barely enough to sweeten

a cup of tea. It is hard work to find, collect, transport and process nectar till the time it becomes the yellow sticky thingyou have with breakfast.The worker bee’s lifespan, which could range from a fewweeks to a few months, is spent making food. It locates flowers

and sucks out the nectar using its long tongue. It has two stomachs—with one being used for storing and transportingnectar. To fill that, it has to visit over a thousand flowers—a

heavy burden indeed.

The bee is not just making food to ensure the survival of its colony through harsh and bloomless winters, it is also cross-pollinating crops, powering a multi-trillion dollar global

agricultural industry and ensuring human survival.

The bee sometimes carries as much cargo as its body weight. The enzymes in its stomach help turn the nectar into honey. Once back at the colony, it pumps out the nectar through

its mouth into the mouth of a receiver bee, which adds its enzymes and vomits the semi-processed honey into an empty hive cell. But the nectar is still thin. Much still needs to be

done. The bee then flaps its wings about 12,000 times a minute to fan and thicken the nectar. Finally, it secretes wax from its abdomen to cover the cell to protect this food, which offers sweet nutrition to help sustain its demanding work life.

A bee’s life reminds us of the little things that lay the foundation of life on Earth. Here is a lesson in personal finance. Bees tell us about the enormous challenges as well as the fitting

rewards of saving up. It is not easy to save money, but save you must. Savings are the building blocks of your finances; the very thing that would one day make it possible for you to buy a home, take that vacation you always wanted, educate your children or retire on

your terms. And just like the bee, you must give it all you have.

Why Save?

Savings make the base of our 5S Pyramid. They enable your

ascent to the peak of the pyramid—Serenity.

Opening a savings account with a bank or post office is the first step in the process of financial growth and the fulfilment of one’s aspirations. All other financial progress stems from here: taking a loan, buying insurance, using your preferred payment app or investing for wealth creation. Just like the satisfaction of one’s physiological needs forms the basis in Maslow’s hierarchy, having a savings account is the crux of the 5S Pyramid.

If you are reading this book, it is likely that you already own one or multiple savings accounts. Therefore, you already know about its basic benefits. As per a World Bank report,

80 per cent of Indian adults owned a savings account as of 2017compared to 53 per cent in 2014.The number may have improved in later years, thanks to the deepening internet and cell phone penetration, and financial awareness. These have enabled digital account openings at a grand scale.

But saving is not merely about ensuring a bank balance. There is much more to it. It is a skill, an art, a science and, above all, a constant challenge. Therefore, over the next few chapters, with the help of case studies, stories and anecdotes, we are going to look at ways that will help you save in a smarter way and help you move from the base of the 5S Pyramid to its peak.

The Importance of Savings

Bank savings constitute a large chunk of household savings in this country. The RBI said in June 2020 that currency and bank deposits formed nearly 70 per cent of India’s household.financial assets.

The central bank describes these assets as ‘bank deposits, debt securities, MFs, insurance, pension funds and small savings’. Of this, commercial bank deposits constitute a whopping 52.6 per cent. Currency holdings are at 13.4 per cent. Deposits with cooperative banks form another 3.8 per cent. These bring the value tied to bank deposits and cash holdings to 69.8 per cent of household assets. Indians are over-dependent on their humble savings account. It, therefore, becomes much more important to use it smartly. It is not enough for a bee to create honey. It should also be able to enjoy it. Savings, when managed smartly, leads to liquidity, which can be used in times of need, insurance against economic risks, better return on investment and timely repayment of debts. Above all, smart savings leads to the achievement of our objective: reaching the apex of our 5S Pyramid, which is Serenity.

How Much Should You Save?

Alpana, an Early Jobber, lost her job as an accountant in Chennai when her company downsized in the aftermath of the 2019 economic slowdown. Many of her peers also lost

their jobs. The situation, however, did not perturb Alpana. She has always followed a simple rule of thumb: she saves up to at least six times her monthly income as a fixed deposit (FD)

with the bank she has her salary account in.

Alpana calls this money her emergency fund. She had started saving up as soon as she had started working. She concluded that to be financially independent, it is not enough

to have a job and an income stream. She knew she also needed money in her account to be truly secure.

When she lost her job, she did not have to return to her hometown, like some of her co-workers. She continued staying in Chennai. Thanks to her savings, she could continue paying rent and meet her other necessary expenses, such as food, healthcare, utilities and transportation. After a three-month wait, she landed a new job. The savings, thus, ensured that Alpana could avoid the setback of being pushed back to her hometown from where a professional comeback could have been difficult.

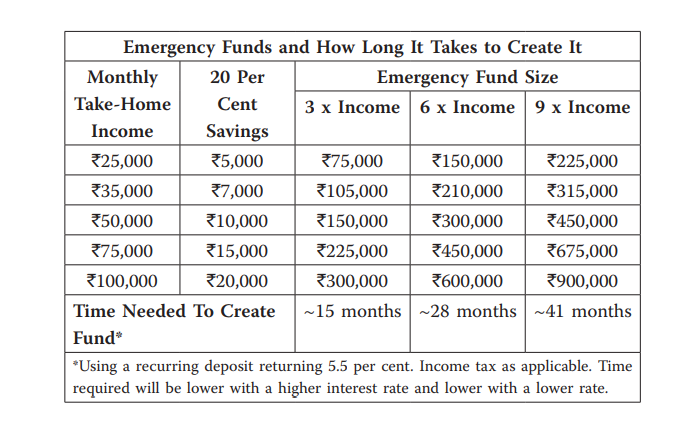

In this book, we are going to examine answers to many questions like these. The answers require calculations. Sometimes, the answer is arrived at by extensive number crunching. At other times, we find the answer through a rule of thumb, which is an oversimplified solution to the problem. For instance, we say that the rule of thumb for an ideal emergency fund is that it should be three to six times your monthly income. This can help you tide over a wide variety of emergencies. But if the risks involved are higher, the emergency fund needs to be bigger. For example, you might have a health condition that requires frequent medical intervention that is not covered by your health insurance.

Note that your progress to savings, which are three to six times your monthly income, will take time. You can start by setting aside at least 20 per cent of your monthly take-home pay

as compulsory savings at the beginning of every month. If you have high disposable income, aim to save a higher per centage. The emergency fund is the most basic form of saving. It is

also necessary not to confuse it with other forms of savings, such as those for retirement, achieving life goals like buying a house, or for children’s education and marriage. Each objective for saving is unique. Each objective requires its own approach for fulfilment. Mixing up your objectives may make it difficult for you to achieve any of them.